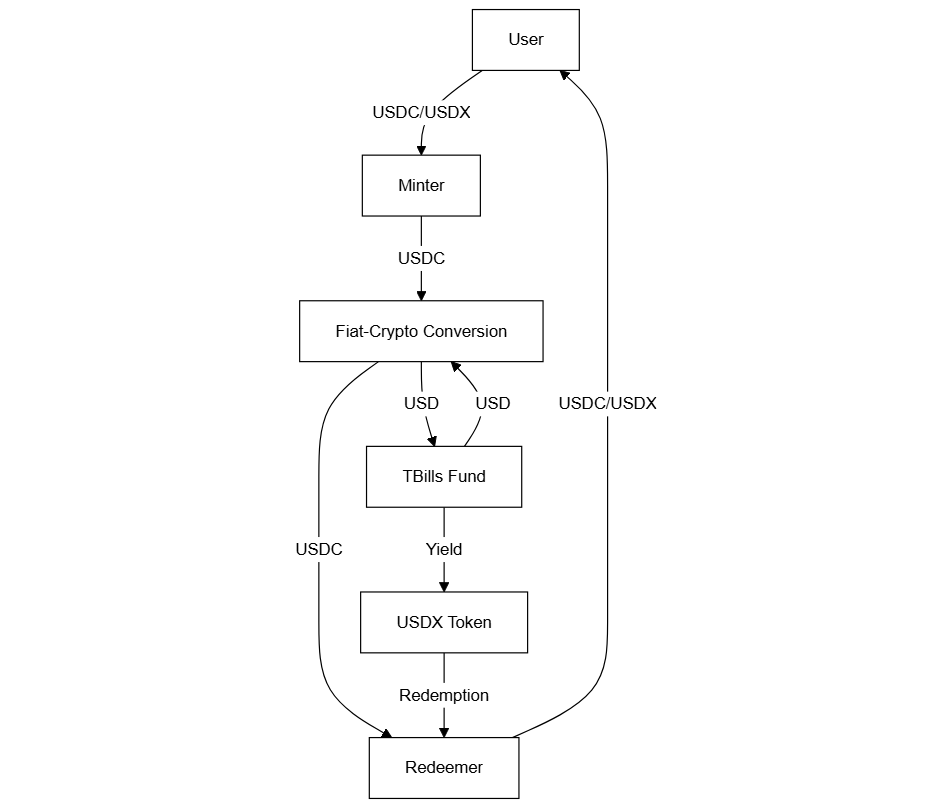

| Ticker | USDX |

| Description | Permissionless yield-bearing stablecoin |

| Use Cases | Cash management, yield-bearing collateral, cross-border payments |

| Underlying | Short duration government securities |

| Eligibility | Qualified Purchasers |

| Liquidity | 24/7 via USDC, Daily via USD |

| Issuer Jurisdiction | Delaware, United States |

| Structure | 1940 Act Closed-End Interval Fund |

| Minimum Mint | $5,000 |

| Minimum Redemption | $5,000 |

| Fee Schedule | Yield share, network gas fee pass-through |

| Available Networks | Ethereum, Avalanche, X Ledger, Stacks, Lightning Network |