FAQs

- Our purpose is to utilize blockchain to enable an inclusive resilient, and frictionless global economy.

- USDX is a permissionless yield-bearing stablecoin for payments.

- Zero expense ratio

- Internet mobility

- Can be used for yield-bearing collateral, no need to sell

- Fractional shares

- No capital gains or income taxes

- 24/7 trading

- Real-time NAV for underlying mutual fund assets

- No txn fees

- Tax-exempt

- Seamless API

- Permissionless

- Zero counterparty risk

- Daily yield distributions

- Transparent real-time NAV

- Fiat onramps for 200+ countries

- Choose from over 8 payment methods

- Hybrid share class structure

- SEC-regulated, United States domiciled

- Backed 1:1 by US government securities

Mutual Funds

- Reduce cash drag 15bps

- Reduce tracking error

- Collateral for redemptions

- Zero equitization

- Zero fails

- Internet mobility

- Index return on idle cash balances

- Convert MF to ETF no taxes

- Convert ETF to MF no taxes

MMF

- Boosts AUM + fee income

- Reduces cash flow volatility

- Increases daily/weekly assets

- Allows for greater counterparty diversification

Payment Providers

- Reduce prefunding from eight days to four

- Reduce FX fees by 20 to 30 bps

- Focus on corporate strategy over day-to-day operations

- Improved access, reduced cost, faster speed, certainty

Investors

- Daily yield on idle cash

- Low minimums

- Instant + certain settlement with 24/7 minting and redemption

- Yield-bearing collateral

Neobanks

- Yield on idle cash balances

- Low minimum investment

- Instant mint and redemption 24/7/365

- Frictionless collateral mobility

- These benefits arise because idle Visa cash inflows via USDX provide more capital for the fund to invest, improving liquidity and stability. This allows for better risk management, the ability to meet redemptions efficiently, and opportunities to pursue higher yields within established risk limits.

Risk Controls

- Customer-Set Order Size Limits

- Price Protections

- Duplicate Order Check

- Messaging Throttles

- Net Exposure Pre-Trade Limits

- Self-Match Prevention

- Cancel on Disconnect

- “Cancel All” Messaging

- Intra-company payments

- Optimize and mobilize your liquidity among connected entities by moving funds domestically or cross-border 24/7/365, including on holidays.

- Inter-company payments

- Speed up commercial settlement and align treasury processes to the real-time nature of the industry by moving funds domestically or cross-border any day and time of the week including on holidays.

- Merchant acquirers and beneficiaries

- Pay acquirers 24/7, and settle funds with certainty on-demand, multiple times a day and minimize need for prefunding and credit lines.

- Unlock idle working capital and liquidity

- Efficiently leverage your existing liquidity by automatically moving funds cross-border in a “follow the sun” model to draw on liquidity as needed.

- USD offshore clearing for financial institutions

- Instantaneously settle and clear USD minimizing the need to prefund or use of credit lines on nostro accounts for financial institutions at XFT.

- Event driven payments

- Automated real time treasury through the use of Programmable Payments using an intuitive ‘if-this-then-that’ web interface.

- Rebasing, daily.

- Managed distributions

- A closed-end interval fund structure further allows USDX to maintain its $1 peg through controlled redemptions and issuance:

How it works

- When price < $1: Fund buys USDX from market

- When price > $1: Fund issues new USDX

- Scheduled redemption windows prevent runs on the fund

- This creates a stable mechanism for keeping USDX at $1

Regulatory Benefits

- 1940 Act registered with SEC

- Compliant with new dealer rules

- Authorized operation in USA

Redemption, tbd

- Backed by:

- Build America Bonds

- Infrastructure (USDX)

- SLGS securities

- Municipal bonds via closed-end funds trading at a discount to NAV

- Revenue bonds

- Conduit bonds

- Learn more here

- No fees. USDX Rewards are accrued daily on a “net” basis. Real time APY can be found on our website.

Fee Events

- Subscription

- Redemption

- Management

- Transaction

- Deposits

- FX conversion

- Rebasing, daily. System matches the stETH / wstETH model which is a simple and battle-tested model.

Examples

- Rebasing

- Price accrual

- Right to redeem their tokens subject to the terms of the offering memorandum

- Right to receive regular performance reports

- Access to portfolio transparency

- XFT unfortunately cannot provide legal, financial, or tax advice. Our users and investors should consult their tax advisors for any tax considerations. Tax events:

Yield / dividends

- 1. Direct distribution of stablecoin to the holder’s wallet.

- 2. Value accrual to a wrapped vault token, wUSDX, reified upon unwrapping.

Purchase & Redemption

- The USDX token issuance and redemption price is determined by the underlying FOBXX price on the stock market. This price is typically very stable at approximately $1 USD per share with minor fluctuations loosely based on dividend timing. We anticipate that holders of USDX will primarily see dividend-based tax implications.

- Asset eligibility criteria is publicly available on our Investment Mandate: USDX Reserves - Investment Mandate

- No concentration limitations.

Benefits

- Faster

- Cheaper

- Global

- Secure

- Open and programmable

- Globally accessible

- Available 24/7/365

- Instant settlement at near-zero cost

Other

- Internet mobility + distribution

- Transparent collateral ownership

- Micropayments + granular divisibility

- Instant settlement at near-zero cost

- No prefunding

- No chargeback risk

- No credit/debit card or bank account needed

- Money Market Funds (MMFs) become more stable if investors can use their MMF shares directly as collateral, instead of selling them for cash. This reduces pressure on MMFs during market stress.

- Traditional: Investor sells MMF shares to get cash for margin call, causing fund outflows.

- Tokenized: Investor uses MMF shares/tokens directly as collateral, avoiding sale and fund outflows.

Tokenized Money Market Fund:

- 1. Investor buys tokenized MMF shares

- 2. Shares held digitally in investor's wallet

- 3. Investor can use tokens as collateral without selling

- 4. Yield accrues to tokens (via price increase or rebasing)

- 5. Investor sells or redeems tokens when needed

Traditional Money Market Fund:

- 1. Investor purchases MMF shares

- 2. Shares held in brokerage account

- 3. To use as collateral, investor must sell shares for cash

- 4. Yield typically distributed or reinvested

- 5. Investor redeems shares for cash when needed

ETFs

- Economies of scale, lower transaction costs

- Capital risk reduction via diversification

- Reduced dealing costs

- Transparency

- Tax efficiency

Money Market Funds

- Improved cash utilization, increased yield, liquidity

- Reduction in tracking error, slippage

Closed-End Funds

- Stable Pricing: Aligns closed-end fund market price with NAV.

- Investor Confidence: Guarantees NAV exits, attracting capital.

- 1. USDX increases the number of tokens daily to reflect yield.

- 2. This allows for more precise yield distribution, as it can add fractional tokens.

- 3. wUSDX, on the other hand, increases in price, which may lead to slight rounding differences.

- Opportunity to Buy at a Discount

- Efficient Portfolio Management

- Ability to Control Market Price and Timing

- Integration With Brokerage Account

- Leverage Potential

- Clear Commissions

- Lower Expense Ratios

- No Minimums

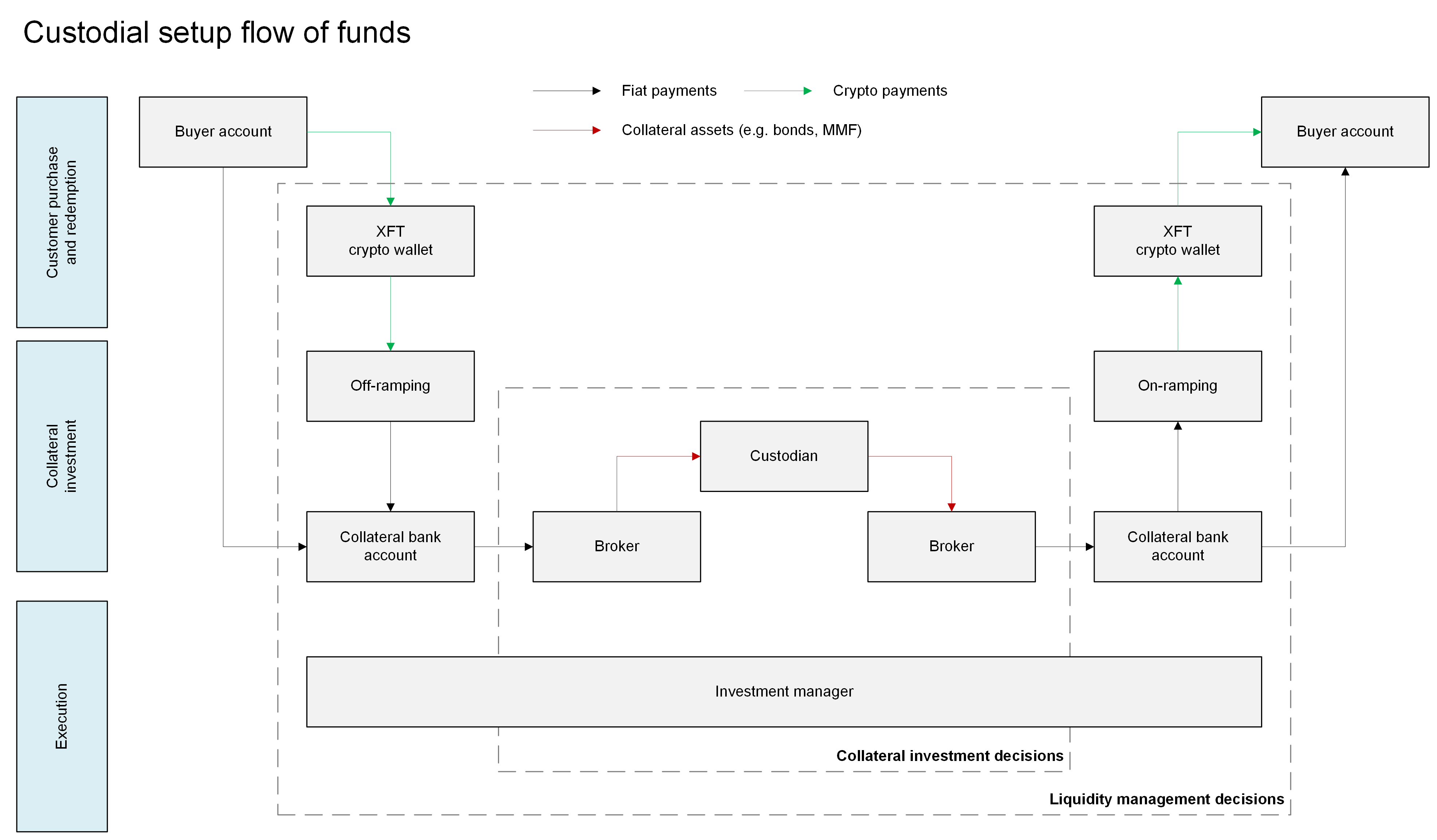

Flows

open customer onboarding flow first + reload

- USDX ENGINE

- 1 Investors deposit cash with USDX’s custodian.

- 2 USDX selects and invests in money market securities according to the Investment Policy of the Fund.

- 3 Purchased securities are held at USDX’s custodian on behalf of the Investors.

- 4 Returns on the portfolio may either be paid to investors periodically or reinvested in the fund.

- MONEY MARKET FUND ENGINE

- 1 Investors deposit cash with the MMF’s custodian.

- 2 The MMF selects and invests in money market securities according to the Investment Policy of the Fund.

- 3 Purchased securities are held at the MMF's custodian on behalf of the Investors.

- 4 Returns on the portfolio may either be paid to investors periodically or reinvested in the fund.

USDX

USDXW

TENDER OFFER

- Fund announces tender offer window

- USDXW holders can submit shares for redemption

- Fund accepts shares up to specified limit

- Redeems USDXW for underlying USDX at NAV

- In-kind distribution maintains tax efficiency

- USDXW supply decreases?

USER

- UNWRAPPING:

- Tokenized muni basket redemption

- Cash redemption NAV

- USDX redemption NAV

- WRAPPING:

- Create USDXW

- Deliever muni basket

- Deliever cash at NAV

- Wrap USDX at NAV

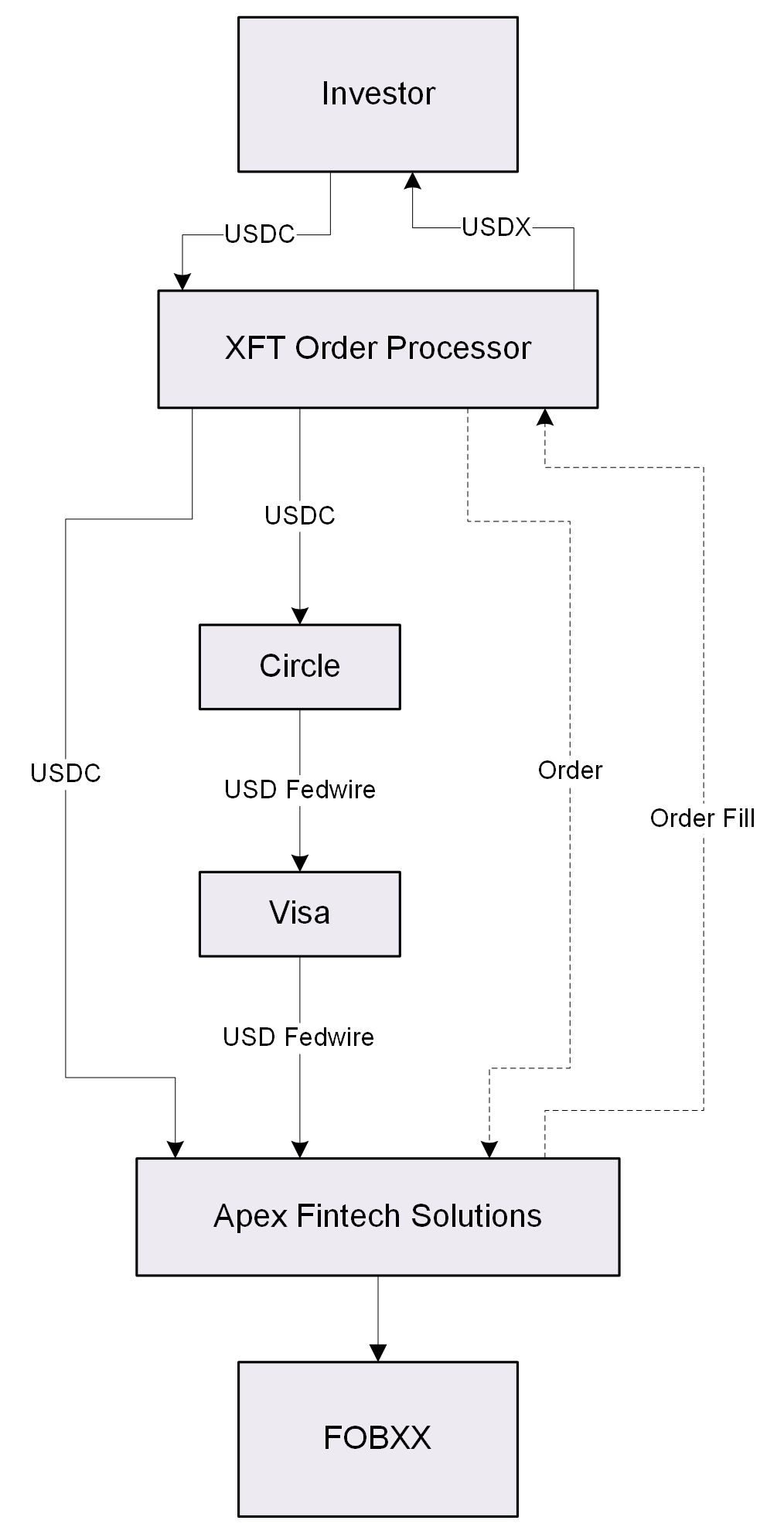

- 1. Create account via /accounts

- 2. Initiate KYC via /kyc/generate-link and complete verification

- 3. Link external account via /external-accounts

- 4. Fund account (USDC/fiat)

- 5. Mint USDX via /stablecoin/mint

- 6. Access and manage wallet via /wallets

Accrual

- 1. Yield generated from underlying portfolio

- 2. Token price increases (e.g., 1.00→1.01)

- 3. Token supply stays fixed

- 4. Total value increases (price * supply)

Rebasing

- 1. Yield generated from underlying portfolio

- 2. More tokens minted (e.g., 100 tokens → 101 tokens)*

- 3. Token price stays pegged at $1.00

- 4. Total value increases (price * supply)

- Authorization

- 1. Fund accrues yield intraday

- 2. PM submits EOD yield data to Oracle

- 3. Oracle verifies data source and portfolio

- 4. Smart contract validates

- Processing

- 5. addRewardMultiplier adds daily yield to multiplier

- 6. rewardMultiplier updates

- Settlement

- 7. User balances auto-update [shares × new rewardMultiplier]

- 8. Total supply adjusts [totalShares × rewardMultiplier]

- 9. Distribution recorded onchain

ARCHITECTURE

Reward Multiplier

POLICY ENGINE

Participants

- Sender

- Recipient

- Stablecoin issuer

- Blockchain network

- Wallet providers

Authorization

- 1. Sender initiates a transfer via their wallet.

- 2. Transaction is broadcast to the blockchain network.

- 3. Network verifies sender’s balance and transaction validity.

- 4. Transaction is approved and added to the blockchain.

Processing

- 5. Transaction is processed on the blockchain.

- 6. Smart contracts execute any required conditions.

- 7. Network nodes confirm the transaction.

Settlement

- 8. Stablecoin is credited to the recipient’s wallet.

- 9. Transaction is permanently recorded on the blockchain.

- 1. Board of directors approves repurchase order

- 2. Notice of repurchase offer sent to shareholders

- 3. File notice on Form N-23c-3 with SEC

- 4. Repurchase request deadline

- 5. Repurchase pricing date

- 6. Repurchase payment deadline

USDX ENGINE

- 1. Investors deposit cash with USDX's custodian.

- 2. USDX selects and invests in money market securities according to the Investment Policy of the Fund.

- 3. Purchased securities are held at USDX's custodian on behalf of the Investors.

- 4. Returns on the portfolio may either be paid to investors periodically or reinvested in the fund.

MONEY MARKET FUND ENGINE

- 1. Investors deposit cash with the MMF's custodian.

- 2. The MMF selects and invests in money market securities according to the Investment Policy of the Fund.

- 3. Purchased securities are held at the MMF's custodian on behalf of the Investors.

- 4. Returns on the portfolio may either be paid to investors periodically or reinvested in the fund.

Business

| Segment | Problem |

|---|---|

| B2B Payments |

Difficult to track High fees Slow Lack transparency |

| Stablecoins |

No yield distribution Lack transparency U.S. regulatory compliance Depegging, USDC reliance |

| Money Market Funds |

Collateral immobility Redemption pressure during market stress Costly and problematic settlement |

| Cash Management |

Idle cash losing value due to inflation High subscription and redemption fees |

| Type | Example | Use Case |

|---|---|---|

| Neobanks | Brex | Cross-border payments |

| Corporate Treasuries | Apple | Yield-bearing collateral |

| Insurance | Prudential | Managing float and reserves with low-risk, yield-bearing collateral |

| Fintech | Robinhood | Yield on idle cash balances |

| MMF Managers | FOBXX | Inflows, counterparty diversification, liquidity risk reduction |

| Customer | Value Proposition |

|---|---|

| MMFs |

Boosts AUM + fee income Reduces cash flow volatility Increases daily/weekly liquid assets Allows for greater counterparty diversification |

| Investors |

Daily yield on idle cash Low minimums Instant settlement + 24/7 minting and redemption Yielding-bearing collateral |

| Payment Providers |

Reduce prefunding from eight days to four Reduce FX fees by 20 to 30 bps Focus on corporate strategy vs. operations Improved access, reduced cost, faster speed, certainty |

USDX

- XFT retains a small fraction (20%) of the corresponding yield, with the rest distributed to USDX token holders through rebasing. Success is measured via the following KPIs:

- 1. USDX TVL

- 2. USDX held on EOAs (as proxy for missionary holders

- 3. USDX held in DeFi protocols on Arbitrum, broken by usage (Lending, Perp, DEX)

- 4. Number of USDX holders

- 5. Volume transacted with USDX

- Margins expand with TVL proportionally.

XFT Coin Systems

- XFT makes money by capturing the difference (spread) between the buying (bid) and selling (ask) prices of tokenized assets on our platform.

- Bid/ask spread

- Tokenization

- Redemption fee

- Arbitrage

- Dividend, interest, coupon

UNITED STATES OF AMERICA

- Trump Can’t Stop De-Dollarization

- Russia and Myanmar Discuss National Currency Payment System

- Pentagon Loses Track of $2.5 Trillion

- Pentagon again fails annual audit of $3.8 trillion in military assets

- Pentagon failed to track more than $1 billion in military gear given Ukraine

- DOD Loses Billions Due to Failed Controls and Poor Fund Tracking

- Pentagon's Defense Logistics Agency loses track of $800m

- Pentagon accounting error provides extra $6.2 billion for Ukraine military aid

- $45 Billion in Tax Dollars Goes Missing in Afghanistan

- Pentagon Lost Track of $220B in Military Equipment

- Trump appoints former PayPal exec David Sacks as crypto czar

- US Treasury Calls for Transparency on China’s Currency Swaps

- China finds world’s largest gold deposit worth over $80 billion

- [BLANK]

INSURANCE

- What’s up with Buffett and his $325 Billion Pile of Cash?

- KKR Closes $4.0 Billion Health Care Strategic Growth Fund II

- Buffett says U.S. corporate taxes likely to rise to tame deficit

- LA Wildfires Losses Could Top $30 Billion for Insurance Industry

- US insurers slump as Los Angeles wildfire loss estimates hit $20 billion

- KKR Completes Acquisition of Remaining 37% of Global Atlantic

- Berkshire reveals $6.72 billion Chubb stake

- [BLANK]

- [BLANK]

CYBERSECURITY

- Authorities say North Korean hackers responsible for $308M Bitcoin theft in Japan

- Chinese hack of US telecoms compromised more firms than previously known

- Chinese hackers breach US Treasury in major cyber attack

- US healthcare payments network restored 9 months after ransomware attack

- Cyberattack cripples US military pharmacies worldwide

- Cyberattack paralyzes New York prescription system

- Pharmacies across USA struggle to process prescriptions after cyberattack

- Patients struggle to get lifesaving medication after healthcare cyberattack

- UnitedHealth cyberattack still impacting prescription access: “threats to life”

- UnitedHealth hack exposes 100M records in largest-ever US healthcare breach

- Lumma Stealer on the Rise

- Cybercrime to cost US companies $5.2 trillion

- Payments system cyber attack to cost the world $3.5 trillion

- Cyber crime costing the world $8 trillion every year

- US sanctions Chinese firm for hacking 81K firewall devices, potentially deadly

- FCC chair proposes cybersecurity rules in response to China's Salt Typhoon telecom hack

- [BLANK]

- [BLANK]

- [BLANK]

REGULATION

- Credit Card Competition Act of 2023

- Digital asset broker tax reporting rules finalized

- Treasury and IRS finalize digital asset tax reporting rules

- SEC expands "dealer" definition to include key market participants

- The patent that helped Vanguard pocket big gains expires

- [BLANK]

- [BLANK]

MARKET

- Pershing Square USA, Ltd. Withdraws IPO

- “stablecoins are real” – Jamie Dimon

- Eaton Vance Municipal Bond Fund Announces Extension of Tender Offer

- Stripe acquires stablecoin platform Bridge for $1.1 billion

- Stablecoins find product-market fit

- Fidelity suffers $3.8 billion mutual fund outflows in 2024

- Why now is the time for municipal bonds

- Franklin hits record AUM despite $48 billion in Western Asset Mgmt outflows

- US equity funds saw biggest net outflows in 15 years ahead of Fed decision

- BlackRock ETF Buys First Muni Bonds Issued Through Blockchain

- [BLANK]

- [BLANK]

- [BLANK]

- [BLANK]

- Internet mobility

- Low minimums

- No slippage

- No chargeback risks

- Zero counterparty risk

- Programmatically banked

- Prefunded transactions

- No capital gains or income taxes

- No management, performance, transaction fees

- Instant 24/7/365 bilateral settlement

- Quantum resistant cryptography

- Daily yield distributions

- SEC regulated

- Global fiat onramps

- Real-time NAV for underlying assets

- Tax-exempt in-kind redemption

- Yield-bearing collateral

- Smart contract collateral

- Redemption collateral

- Secure payment systems

- Tax management

- Self-custodied bank account

- No management, performance, transaction fees

- Outflow reduction

- Cash drag reduction

- Fractional shares

- Cross-border payments

- Intra-company payments

- Inter-company payments

- Event driven payments

- Tracking error reduction

- Return from low-risk US government securities

Municipal Bonds

- High dividends

- Tax free

- Safe

- Rising NAVs

Closed-end funds

- Managed distributions

- Fixed supply

- Compliance

- Not required to redeem if outflows

- "The one advantage that a closed-end fund or ETF has over an open-end fund is that it cannot be forced to sell stocks because of redemptions. If shareholders in an open-end fund want to redeem more shares than the dividends the fund receives, the fund must sell stock and realize capital gains. In an ETF, shares are redeemed in-kind by institutions, so there is no tax consequence. In a closed-end fund, shareholders cannot have net redemptions; if they want to sell, they must find a buyer on the market."

- Total Return (Yield Driven)

- Diversification

- Professional Management

- Leverage Used by Fund

- Free Leverage of The Discount

- Control: Limit & Stop Orders

- Fixed Capitalization: No Redemption Pressures

- Capitalize on Market Inefficiencies

- Low Active Institutional Ownership / Mostly Retail

Reduced reinvestment risk

- Open-end mutual funds face the challenges of reinvesting incoming cash from new investors and keeping cash on hand to meet investor redemptions. This can disrupt the fund's investment strategy, forcing sales of existing holdings to accommodate new capital.

- CEFs, on the other hand, avoid this issue. With a fixed pool of capital, the manager can focus on long-term investment decisions without worrying about short-term cash flows. Furthermore, a closed-end fund manager does not need to hold excess cash to meet redemptions, meaning more of the portfolio can be invested.

Flexibility for illiquid assets

- CEFs' historically stable capital base allows them to invest in less liquid assets such as emerging market debt and private equity.

- Open-end funds with frequent redemptions may struggle to hold these assets, as selling them quickly to meet investor redemptions might be difficult. CEFs, with their predetermined capital, can take advantage of these potentially higher-return opportunities without liquidity concerns.

- Investor gets NAV value vs discount

- Tax efficient in-kind transaction

- Exits at NAV

- Second layer of liquidity for fixed share investment products

USE CASES

- Arbitrage

- Activist prevention

- A Series Trust can house funds with different structures (e.g., ETF, mutual fund, interval fund).

- Fixed repurchase frequency = transparency

- Interval: fixed schedule

- Tender: discretion

- Enables an interval or tender offer fund to replenish cash that can be used to satisfy periodic repurchase offers.

- Can alleviate the need to sell existing portfolio holdings to generate cash for new investments.

- Allows the fund to take in cash to pursue new investment opportunities.

Prospectus

- XFT Municipal Income Fund (the “Fund”) is a continuously offered, diversified, closed-end management investment company that intends to operate as an interval fund. As an interval fund, the Fund will offer to make repurchases of between 5% and 25% of its outstanding shares at net asset value (“NAV”), on a quarterly basis, unless such offer is suspended or postponed in accordance with regulatory requirements.

- XFT Municipal Money Market Fund’s investment objective is to seek to provide current income that is exempt from federal personal income taxes while maintaining liquidity and a stable share price of $1. As such it is considered one of the most conservative investment options offered by XFT. Although the fund invests in short-term, high-quality securities, the amount of income that a shareholder may receive will be largely dependent on the current interest rate environment and the availability of eligible municipal securities. Investors in a higher tax bracket who have a short-term savings goal and seek a competitive tax-free yield may wish to consider this option.

- The Fund seeks to provide current income that is exempt from federal personal income taxes while maintaining liquidity and a stable share price of $1.

Investment Goal

- Maintain $1.00 share price

- Tax exemption

- Yield

- Maintain stable $1.00 share price

- Tax exemption

- Yield

- RIC status; avoids US income tax if income and gains are distributed.

OR

- Tax exemption via municipal bond portfolio

- Frequent flyer miles and reward points

- Distribute daily variable dollar amounts to maintain $1 NAV per managed distribution policy.

Methods

- Increase distribution if NAV > $1

- Distribute income to avoid NAV growth

- Return capital to offset premium

- Reduce distribution if NAV < $1

- The following tables describe the fees and expenses you may pay if you buy, hold, and sell Dollar Shares or DeFi Shares of the Fund. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the tables and examples below.

Annual Fund Operating Expenses

(Expenses that you pay each year as a percentage of the value of your investment)

(Expenses that you pay each year as a percentage of the value of your investment)

|

|

|

|

Management Fees

|

0.00

%

|

|

12b-1 Distribution Fee

|

None

|

|

Other Expenses

|

0.01

%

|

|

Total Annual Fund Operating Expenses

|

0.01

%

|

Examples

The following examples are intended to help you compare the cost of investing in

the Fund’s Dollar Shares or DeFi Shares with the cost of investing in other

mutual funds. They illustrate the hypothetical expenses that you would incur over

various periods if you were to invest $10,000 in the Fund’s shares. These

examples assume that the shares provide a return of 5% each year and that total

annual fund operating expenses remain as stated in the preceding table. You

would incur these hypothetical expenses whether or not you were to redeem

your investment at the end of the given period. Although your actual costs may

be higher or lower, based on these assumptions your costs would be:

|

|

1 Year

|

3 Years

|

5 Years

|

10 Years

|

|

Dollar Shares

|

$17

|

$55

|

$96

|

$217

|

|

DeFi Shares

|

$9

|

$29

|

$51

|

$115

|

- The Fund invests in a variety of high-quality, short-term municipal securities. To be considered high quality, a security must be determined by XFT to present minimal credit risk based in part on a consideration of maturity, portfolio diversification, portfolio liquidity, and credit quality. The Fund invests in securities with effective maturities of 397 days or less, maintains a dollar-weighted average maturity of 60 days or less, and maintains a dollar-weighted average life of 120 days or less.

Principal Risks

The Fund is designed for investors with a low tolerance for risk, but you could still

lose money by investing in it.

The Fund is subject to the following risks, which

could affect the Fund’s performance, and the level of risk may vary based on

market conditions:

•

Income risk

, which is the chance that the Fund’s income will decline because

of falling interest rates. Income risk is generally high for short-term bond funds,

so investors should expect the Fund’s monthly income to fluctuate accordingly.

•

Interest rate risk

, which is the chance that bond prices overall will decline

because of rising interest rates. Interest rate risk should be low for the Fund

because it invests primarily in short-term bonds, whose prices are less sensitive

to interest rate changes than are the prices of longer-term bonds.

•

Call risk

, which is the chance that during periods of falling interest rates,

issuers of callable bonds may call (redeem) securities with higher coupon rates

or interest rates before their maturity dates. The Fund would then lose any price

appreciation above the bond’s call price and would be forced to reinvest the

unanticipated proceeds at lower interest rates, resulting in a decline in the Fund’s

income. Such redemptions and subsequent reinvestments would also increase

the Fund’s portfolio turnover rate. Call risk is generally low for short-term

bond funds.

•

Extension risk

, which is the chance that during periods of rising interest rates,

certain debt securities will be paid off substantially more slowly than originally

anticipated, and the value of those securities may fall. Extension risk is generally

low for short-term bond funds.

•

Credit risk

, which is the chance that a bond issuer will fail to pay interest or

principal in a timely manner or that negative perceptions of the issuer’s ability to

make such payments will cause the price of that bond to decline. In general,

credit risk should be relatively low for the Fund because it invests primarily in

bonds that are considered to be of high quality.

•

Liquidity risk

, which is the chance that the Fund may not be able to sell a

security, including restricted securities, in a timely manner at a desired price.

•

Manager risk

, which is the chance that poor security selection will cause the

Fund to underperform relevant benchmarks or other funds with a similar

investment objective.

•

Tax risk

, which is the chance that all or a portion of the tax-exempt income

from municipal bonds held by the Fund will be declared taxable, possibly with

retroactive effect, because of unfavorable changes in tax laws, adverse

interpretations by the Internal Revenue Service or state or local tax authorities, or

noncompliant conduct of a bond issuer.

- You could lose money by investing in the Fund. Although the Fund seeks to preserve the value of your investment at $1.00 per share, it cannot guarantee it will do so. The Fund may impose a fee upon sale of your shares. An investment in the Fund is not a bank account and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. The Fund’s sponsor is not required to reimburse the Fund for losses, and you should not expect that the sponsor will provide financial support to the Fund at any time, including during periods of market stress.

- You may purchase or redeem shares online through our website (xft.finance). The minimum investment amount required to open and maintain a Fund account for Investor Shares or DeFi Shares is $3,000 or $50,000, respectively. The minimum investment amount required to add to an existing Fund account is generally $1. Financial intermediaries, institutional clients, and XFT-advised clients should contact XFT for information on special eligibility rules that may apply to them regarding DeFi Shares. If you are investing through an intermediary, please contact that firm directly for more information regarding your eligibility.

- The Fund’s distributions may be taxable as ordinary income or capital gain. A majority of the income dividends that you receive from the Fund are expected to be exempt from federal income taxes. However, a portion of the Fund’s distributions may be subject to federal, state, or local income taxes or the federal alternative minimum tax.

- The Fund and its investment advisor do not pay financial intermediaries for sales of Fund shares.

| CIK | ||

| Series | ||

| Class/Contract | Name | Symbol |

| 0000225997 | XFT MUNICIPAL BOND FUNDS | |

| S000002892 | XFT High-Yield Tax-Exempt Fund | |

| 0x81536233C3FfaEa0198D7B5Ce8dEceDf3C520A66 | Dollar Tokens | USDX |

| C000007950 | DeFi Shares | USDXW |

- Structure

- Non-diversified, closed-end management company registered under the 1940 Act

- Distribution Policy

- Distributes daily variable dollar amounts per managed distribution policy, benchmarked to CEFA's Municipal Bond Select portfolio.

- Tax Treatment

- The Company intends to elect to be treated as a regulated investment company (RIC); if qualified, the Company will not be subject to US income tax to the extent income and gains are distributed

- Delaware Series Trust

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-8A

NOTIFICATION OF REGISTRATION FILED PURSUANT

TO SECTION 8(A) OF THE INVESTMENT COMPANY ACT OF 1940

The undersigned investment company hereby notifies the Securities

and Exchange Commission that it registers under and pursuant to the

provisions of Section 8(a) of the Investment Company Act of 1940 and in

connection with such notification of registration submits the following

information:

Name: XFT Municipal Income Trust

Address of Principal Business Office (No. & Street, City, State, Zip Code):

c/o X Financial Technologies, Inc.

100 Bellevue Parkway

Wilmington, Delaware 19809

Telephone Number (including area code):

(888) 825-2257

Name and address of agent for service of process:

Alexander M. Reed

c/o X Financial Management, Inc.

345 Park Avenue

New York, New York 10154

With copies of Notices and Communications to:

Satoshi T. Nakamoto, Esq.

Satoshi T. Nakamoto, Esq.

Skadden, Arps, Slate, Meagher & Flom LLP

Four Times Square

New York, New York 10026

Check Appropriate Box:

Registrant is filing a Registration Statement pursuant to

Section 8(b) of the Investment Company Act of 1940 concurrently with the

filing of Form N-8A:

YES [X] NO [ ]

SIGNATURE

Pursuant to the requirements of the Investment Company Act of 1940,

the sole trustee of the registrant has caused this notification of

registration to be duly signed on behalf of the registrant in the city of

New York and the state of New York on the 3rd day of April, 2001.

[SEAL]

XFT Municipal Income Trust

(REGISTRANT)

By: /s/ Alexander M. Reed

-------------------------

Alexander M. Reed

Sole Trustee

Attest: /s/ Alexander M. Reed

------------------------

Alexander M. Reed

Sole Trustee

- [BLANK]

- [BLANK]

- [BLANK]

Education

FUND

REGISTRATION Name Structure Asset Group Asset Sub-Group Sponsor Subadvisor Custodian Transfer Agency Securities Act CCO Underwriters Accountants Non-diversified Security Lending Authorized Fund Lend Securities Rules and Exemptions Expense Limitation Arrangement Expenses Were Waived Pricing Services Administrators Purchases / Sales Aggregate Rights Offerings Secondary Offerings Repurchased Securities Default on long term debt Dividends in Arrears Modified Securities N-CEN Date Redemption Details Investment Objective Portfolio Managers Suitability NAV Frequency Hurdle Rate (%) Term Date SEC Effect Date Incentive Fee Incentive Type Incentive Details Incentive - Income Based ($) Incentive - Cap Gain Based ($) FINANCIALS Latest Assets Date Total Assets / AUM Net Assets Shareholder Report Date Reported Total Assets Reported Net Assets Reported Investemnts Fair Value Leverage Assets Leverage Type Leverage Expense Shares sold / Reinvested - 1Yr ($) Shares redeemed - 1 Yr ($) Turnover Rate UNII Maturity Duration PERFORMANCE Reported Performance Date Reported Performance (1mo) Reported Performance (3mo) Reported Performance (6mo) Reported Performance (1yr) Reported Performance (2yr) Reported Performance (3yr) Net Flow (1mo) Net Flow (3mo) Net Flow (6mo) Net Flow (1yr) Net Flow (2yr) Net Flow (3yr) Inflow 3mo(%) Outflow 3mo(%) Inflow 6mo(%) Outflow 6mo(%) Inflow 1yr(%) Outflow 1yr(%) Weighted Maturity Weighted Maturity <1yr Weighted Maturity 1-3yr Weighted Maturity 3-5yr Weighted Maturity 5-10yr Weighted Maturity 10-20yr Weighted Maturity >20yr Avg Coupon PORTFOLIO Companies # Holdings # Bond # Equity # Top Companies #1 Top Companies #1 % Top Companies #2 Top Companies #2 % Top Companies #3 Top Companies #3 % Top Companies #4 Top Companies #4 % Top Companies #5 Top Companies #5 % Top Companies #6 Top Companies #6 % Top Companies #7 Top Companies #7 % Top Companies #8 Top Companies #8 % Top Companies #9 Top Companies #9 % Top Companies #10 Top Companies #10 % Top Companies Date U.S. Equity Non U.S. Equity U.S. Bond Non U.S. Bond Cash Asset Alloc #1 Asset Alloc #1 % Asset Alloc #2 Asset Alloc #2 % Asset Alloc #3 Asset Alloc #3 % Small Cap Mid Cap Big Cap Variable Rate Bond Fixed Rate Bond Payoff Profile: long Payoff Profile: short Restricted Fair Value level 1 Fair Value level 2 Fair Value level 3 Default Bond Deferred Bond Portfolio List Date REPURCHASES Latest Completed Repurchase Date Offered to Repurchase Last Completed Repurchase (%) Repurchased 1yr (%)

SHARE CLASS

GENERAL Fund Name Class Ticker Class Name Structure Asset Group Asset Sub-Group Sponsor Inception Date Dividend Frequency Min Investment CUSIP Shares Outstanding DISTRIBUTIONS Latest Distribution Latest Distribution Date REPURCHASE Latest Repurchase - Start Latest Repurchase - End To Repurchase (%) Current Offering FEE STRUCTURE Max Load Early Withdrawal Fee Mgmt Fee 12b-1 Fee Other Expenses Interest Underlying fund fees Incentive Fee Waivers Total Fees Total Fees (net of Waivers) Gross Exp Ratio Net Exp Ratio PERFORMANCE NAV/Share NAV Date Indicated Yield Trailing Yield Div Growth (1yr) Div Growth (3yr) NAV TR (1mo) NAV TR (3mo) NAV TR (6mo) NAV TR (1yr) NAV TR (3yr) NAV TR Inception NAV TR Date

PRINCIPAL TRANSACTIONS

ID Fund Name Structure Asset Group Asset Sub-Group Sponsor Principal LEI Purchases / Sales Txn Date

DIRECTORS

ID Fund Name Structure Asset Group Asset Sub-Group Sponsor Principal LEI Purchases / Sales Date

- Investment Advisor

- Principal Underwriter

- Legal Counsel

- Administrator

- Transfer Agent

- Custodian

- Auditor

- Fund Officer

- Mutual Fund Shares

- A, B, C (Retail)

- I (Institutional)

- R (Retirement)

- ETF Shares

- Token Shares

- Rebasing

- Accumulating

- NL Shares

- BDC

- CEF

Closed-End Funds

| NAV = (Market Value of All Securities Held by Fund + Cash and Equivalent Holdings – Fund Liabilities) ÷ Total Fund Shares Outstanding |

| Premium/Discount = (Market Price – NAV) ÷ NAV |

PRICING DYNAMICS

Market Driven

ETF

Closed-end funds

NAV Driven

Mutual Funds shares

Rebasing tokens

Accumulating tokens

ETF

- AP

- No support for automatic reinvestment and withdrawals

- Creation

- AP delivers basket of securities/cash to ETF issuer

- Issuer provides AP with ETF creation units of equal value

- AP sells ETF units to investors on exchange

- Redemption

- AP accumulates ETF units freom investors

- AP exchanges units with issuer

- Issuer returns equivalent basket of securities/cash to AP

Mutual Fund

Closed-End

- Examples:

- All SEC forms

- Exhibits

- Muni CEFs

- Exhibits

- Filing Fees

- N-2A

- 485BPOS

Open-End Investment Companies

MATERIAL

Summary Prospectus

Base Prospectus

Statement of Additional Information (SAI)

FORM TYPES

N-8A, Notification of registration

N-1A, Registration statement

N-1A/A, Registration statement amendment

485APOS, Rule 485(a)

485BPOS, Rule 485(b)

497K, Summary prospectus

497, Base prospectus

TABLE OF CONTENTS

-----------------

FUND SUMMARY

> INVESTMENT OBJECTIVE

> FEES AND EXPENSES

> PRINCIPAL INVESTMENT STRATEGIES

> USE OF BLOCKCHAIN

> PRINCIPAL RISKS

> PERFORMANCE

> INVESTMENT MANAGER

> PURCHASE AND SALE OF FUND SHARES

> TAXES

FUND DETAILS

> INVESTMENT GOAL

> PRINCIPAL INVESTMENT POLICIES AND PRACTICES

> USE OF BLOCKCHAIN

> PRINCIPAL RISKS

> MANAGEMENT

> DISTRIBUTION AND TAXES

> FINANCIAL HIGHLIGHTS

STATEMENT OF ADDITIONAL INFORMATION

> GOALS, STRATEGIES AND RISKS

> OFFICERS AND TRUSTEES

> PROXY VOTING POLICIES AND PROCEDURES

> MANAGEMENT AND OTHER SERVICES

> PORTFOLIO TRANSACTIONS

> DISTRIBUTION AND TAXES

> ORGANIZATION, VOTING RIGHTS AND PRINCIPAL HOLDERS

> BUYING AND SELLING SHARES

> PRICING SHARES

> THE UNDERWRITER

> DESCRIPTION OF RATINGS

Closed-End Investment Companies

MATERIAL

Summary Prospectus

Base Prospectus

Statement of Additional Information (SAI)

FORM TYPES

N-8A, Notification of registration

N-2, Registration statement

N-2/A, Registration statement amendment

424B1, Prospectus disclosing omitted info

424B2, Prospectus for delayed offering with pricing

424B3, Prospectus with updates to last filing

424B4, Prospectus combining B1+B3

424B5, Prospectus combining B2+B3

N-23C-2, Notice of intention to redeem securities

TABLE OF CONTENTS

-----------------

N-2

> PROSPECTUS SUMMARY

> SUMMARY OF FUND EXPENSES

> FINANCIAL HIGHLIGHTS

> USE OF PROCEEDS

> THE FUND

> DESCRIPTION OF CAPITAL STOCK

> THE FUND'S INVESTMENTS

> LEVERAGE

> RISKS

> HOW THE FUND MANAGES RISK

> MANAGEMENT OF THE FUND

> NET ASSET VALUE

> DISTRIBUTIONS

> DIVIDEND REINVESTMENT PLAN

> RIGHTS OFFERING

> TAX MATTERS

> TAXATION OF HOLDERS RIGHTS

> CERTAIN PROVISIONS IN THE CHARTER AND BYLAWS

> CLOSED-END FUND STRUCTURE

> REPURCHASE OF COMMON SHARES

> PLAN OF DISTRIBUTION

> INCORPORATION BY REFERENCE

> PRIVACY PRINCIPLES OF THE FUND

PROSPECTUS SUMMARY

> THE FUND

> THE OFFERING

> USE OF PROCEEDS

> INVESTMENT OBJECTIVE AND POLICIES

> LEVERAGE

> INVESTMENT ADVISOR

> DISTRIBUTIONS

> LISTING

> CUSTODIAN AND TRANSFER AGENT

> ADMINISTRATOR

> MARKET PRICE OF SHARES

> SPECIAL RISK CONSIDERATIONS

Exhibits

FORM N-2 REQUIREMENTS

EX-99.A Charter copies currently in effect

EX-99.B Existing bylaws or corresponding instruments

EX-99.C Voting trust agreements (>5% of equity securities)

EX-99.D Documents defining security holders' rights

EX-99.E Dividend reinvestment plan document

EX-99.F Instruments defining long-term debt rights for subsidiaries

EX-99.G Investment advisory contracts for asset management

EX-99.H Underwriting/distribution contracts and agreements

EX-99.I Bonus/profit sharing/pension contracts for directors/officers

EX-99.J Custodian agreements and depository contracts

EX-99.K Other material non-ordinary business contracts

EX-99.L Legal opinion on securities registration

EX-99.M Non-resident consent to service of process

EX-99.N Other opinions/appraisals/rulings and consents

EX-99.O Omitted financial statements from Items 8.6 or 24

EX-99.P Initial capital agreements and investment assurance

EX-99.Q Retirement plan model documents

EX-99.R Ethics codes under Rule 17j-1

EX-99.S Securities registration information in tabular form

- [BLANK]

TYPE DESCRIPTION

----------------------------------------------------------------------------------------------

EX-99.A AGREEMENT AND DECLARATION OF TRUST

EX-99.B BY-LAWS

EX-99.E DIVIDEND REINVESTMENT PLAN

EX-99.G FORM OF INVESTMENT MANAGEMENT AGREEMENT BETWEEN REGISTRANT AND [*]

EX-99.I DEFERRED COMPENSATION PLAN

EX-99.J FORM OF MASTER CUSTODIAN AGREEMENT WITH [*]

EX-99.K.1 FORM OF TRANSFER AGENCY AGREEMENT

EX-99.K.2 FORM OF ADMINISTRATION AND FUND ACCOUNTING SERVICES AGREEMENT WITH [*]

EX-99.K.3 FORM OF SECURITIES LENDING AGREEMENT

EX-99.K.4 FORM OF EXPENSE REIMBURSEMENT AGREEMENT

EX-99.2H FORM OF UNDERWRITING AGREEMENT

EX-99.2K.5 FORM OF DTC REPRESENTATIONS LETTER

EX-99.2L.1 OPINION AND CONSENT OF COUNSEL

EX-99.2L.2 TAX OPINION OF COUNSEL

EX-99.N CONSENT OF [*]

EX-99.P INITIAL SUBSCRIPTION AGREEMENT

EX-99.R CODE OF ETHICS OF THE REGISTRANT AND THE ADVISOR

EX-99.S POWERS OF ATTORNEY

EX-FILING FEES CALCULATION OF FILING FEE TABLE

INVESTMENT COMPANY STRUCTURE

> Delaware statutory trust (DST)

> Series = hubs, underlying investment portfolio

> Classes = spokes

SERIES

XFT High-Yield Tax-Exempt Fund

XFT Intermediate-Term Tax-Exempt Fund

XFT Limited Term Tax-Exempt Fund

XFT Long-Term Tax-Exempt Fund

XFT Ultra-Short-Term Tax-Exempt Fund

XFT Tax-Exempt Bond Index Fund

XFT Municipal Money Market Fund

XFT Intermediate-Term Tax-Exempt Bond ETF

XFT Core Tax-Exempt Bond ETF

XFT Short Duration Tax-Exempt Bond ETF

CLASSES

Mutual Fund Shares

A, B, C (Retail)

I (Institutional)

R (Retirement)

ETF Shares

Token Shares

- Managed Distribute exact daily earnings to maintain $1 NAV

- None No regular distributions, fund accumulates earnings

- Level Fixed distribution regardless of earnings

- Annual Minimum Distributes minimum amount once per year

- Bank Debt

- Credit Facility

- Margin Loans

- Preferred

- ARPS (Auction Rate Preferred Shares)

- MRPS (Mandatory Redeemable Preferred Shares)

- VMTP (Variable Rate Municipal Term Preferred)

- VRDP (Variable Rate Demand Preferred)

- RVMTP (Remarketable Variable Rate Municipal Term Preferred)

- VRTP (Variable Rate Term Preferred)

- Private Preferred

- Convertible Preferred

- Portfolio

- Repos (Repurchase Agreements)

- TOBs (Tender Option Bonds)

- Swaps

- Securities sold short

- RIBs (Residual Interest Bonds)

- Fwd Contracts

- TBA-MBS

- Collateral on Lending

- Notes

- Private Notes

- [BLANK]

- [BLANK]

Proof System

- Proof of reserves

- Proof of deposits

- [BLANK]