XFT Short Duration US Government Securities Fund

Investment Objective

The Fund invests at least 99.5% of its total assets in cash, U.S. Treasury bills, notes and other obligations issued or guaranteed as to principal and interest by the U.S. Government, its agencies or instrumentalities, and repurchase agreements secured by such obligations or cash. The Fund invests in securities maturing in 397 days or less (with certain exceptions) and the portfolio will have a dollar-weighted average maturity of 60 days or less and a dollar-weighted average life of 120 days or less. The Fund may invest in variable and floating rate instruments, and transact in securities on a when-issued, delayed delivery or forward commitment basis.

Holdings

Resources

About USDX

The XFT Short-Term US Government Treasuries (USDX) Fund is an onchain financial product that provides users with secure access to short-term US Treasuries. USDX targets stable returns in line with short-term US Treasuries and other cash equivalents, with a focus on liquidity and principal preservation. USDX is designed with liquidity and ease-of-use in mind, supporting instant, 24/7 subscriptions and redemptions via USDC (with USDS coming soon).

Key Features:

- 1. Instant, 24/7 Minting and Redemption. Get in and out of USDX within a single block.

- 2. No Slippage. When you redeem from the Fund, the price onchain is the price you get.

- 3. Low Minimum Transaction Size. Instantly mint or redeem as little as $5,000.

- 4. Low Fees. Management fees and fund expenses are capped at 0.15% each, with management fees waived until 2025.

- 5. Quality Assets. USDX only invests in high-quality, highly-liquid, short-duration US Treasuries and other cash equivalents.

Use Cases:

- 1. Cash Management. Earn low-risk yield on your cash with the benefits of instant, 24/7 minting and redeeming.

- 2. Borrowing & Lending. Keep earning yield when you pledge USDX as collateral for borrowing.

- 3. Bilateral Settlement. Instantly settle transactions while continuously earning yield.

Underlying Assets

Over 99.5% of USDX’s assets are currently invested in the Franklin Onchain U.S. Government Money Fund (FOBXX), which in turn invests 100% of its assets in cash, US Treasuries, and repurchase agreements. USDX may also temporarily hold shares in BlackRock’s FedFund (TFDXX), bank deposits, and USDC and other stablecoins for liquidity purposes.

FBOXX Details

- FBOXX seeks to offer a stable value of $1 per token. The Fund invests 100% of its total assets in cash, US Treasury bills, and repurchase agreements, allowing investors to earn yield while holding the token on the blockchain.

USDX vs rUSDX

How is yield transferred to the tokenholder and how often?

USDX is available in two versions, an accumulating token (USDX) and a rebasing token (rUSDX). While both versions pay out yield upon redemption and accrue yield daily, the manner in which the accrual is represented differs.

For USDX, the accruing yield gets ‘accumulated’ into the token price. As the underlying investments accrue yield daily, we recognize this yield by increasing the Net Asset Value (NAV) of the underlying Fund, thereby increasing the NAV per USDX token. We typically update the price once every Business Day, generally at around 6pm ET.

rUSDX, on the other hand, is intended to maintain a price of $1.00 per token, with the accruing yield represented by the division of rUSDX tokens into more tokens via rebasing. See our support documentation to learn more.

As an example, let’s say you held 1 USDX token worth $100 and 100 rUSDX tokens worth $1.00 each. The next day the NAV per USDX token increased to $101 per token. After the price update and rebasing, your holdings of both rUSDX and USDX would be worth $101.00 each ($202.00 in total). You would still have a balance of 1 USDX token worth $101.00. However, due to the rebasing nature of rUSDX tokens, you would now hold 101 rUSDX tokens worth $1.00 per token.

USDX

- 1. Deposit: KYC-verified user deposits USDC or fiat to X Protocol.

- 2. Minting: USDX is minted at a 1:1 rate with USD.

- 3. Rebasing: T-bill yields are distributed daily via a reward multiplier, increasing USDX balances.

- 4. Transfer: Users can transfer USDX, subject to pausing, blocklist checks, and EIP-2612 permits.

- 5. Redemption: Users burn USDX to redeem USDC or fiat at a 1:1 rate.

- 6. Peg Maintenance: Primary market buys/sells USDX at 1 USD to maintain peg.

- 7. wUSDX Wrapping: Users can wrap USDX into non-rebasing wUSDX for DeFi integrations.

wUSDX

- 1. Wrap/Unwrap: Users deposit USDX for wUSDX (non-rebasing), enabling DeFi compatibility.

- 2. Governance: wUSDX follows USDX’s blocklist and pausing rules.

- 3. Permit: wUSDX supports EIP-2612 for gasless approvals.

Subscription

- 1. Client submits purchase order for desired amount (cutoff is 12:00 pm ET)

- 2. Client sends USDC to blockchain address provided by XFT (cutoff is 1:00 pm ET)

- 3. XFT confirms receipt of USDC

- 4. Stablecoin conversion:

- XFT sends USDC to XFT’s Circle account

- XFT Circle account burns USDC and WisdomTree sends USD to the Fund custody account

- 5. Order fulfillment:

- Order fulfilled following 4:00 pm ET NAV calculation

- XFT transfers records of shareholder ownership

- XFT mints USDX tokens and sends tokens to the client’s wallet address

Redemption

- 1. Client submits redemption order for desired amount (cutoff is 12:00 pm ET)

- 2. Client sends USDX tokens to specified XFT wallet (cutoff is 1:00 pm ET)

- 3. XFT confirms receipt of USDX tokens

- 4. Order fulfillment:

- XFT burns USDX tokens

- Order fulfilled following 4:00 pm ET NAV calculation

- XFT transfers updates records of shareholder ownership

- 5. Stablecoin conversion:

- XFT sends redemption value amount in USD to XFT Circle Account

- XFT Circle Account mints USDC and sends to client’s wallet address directly

Fund structure

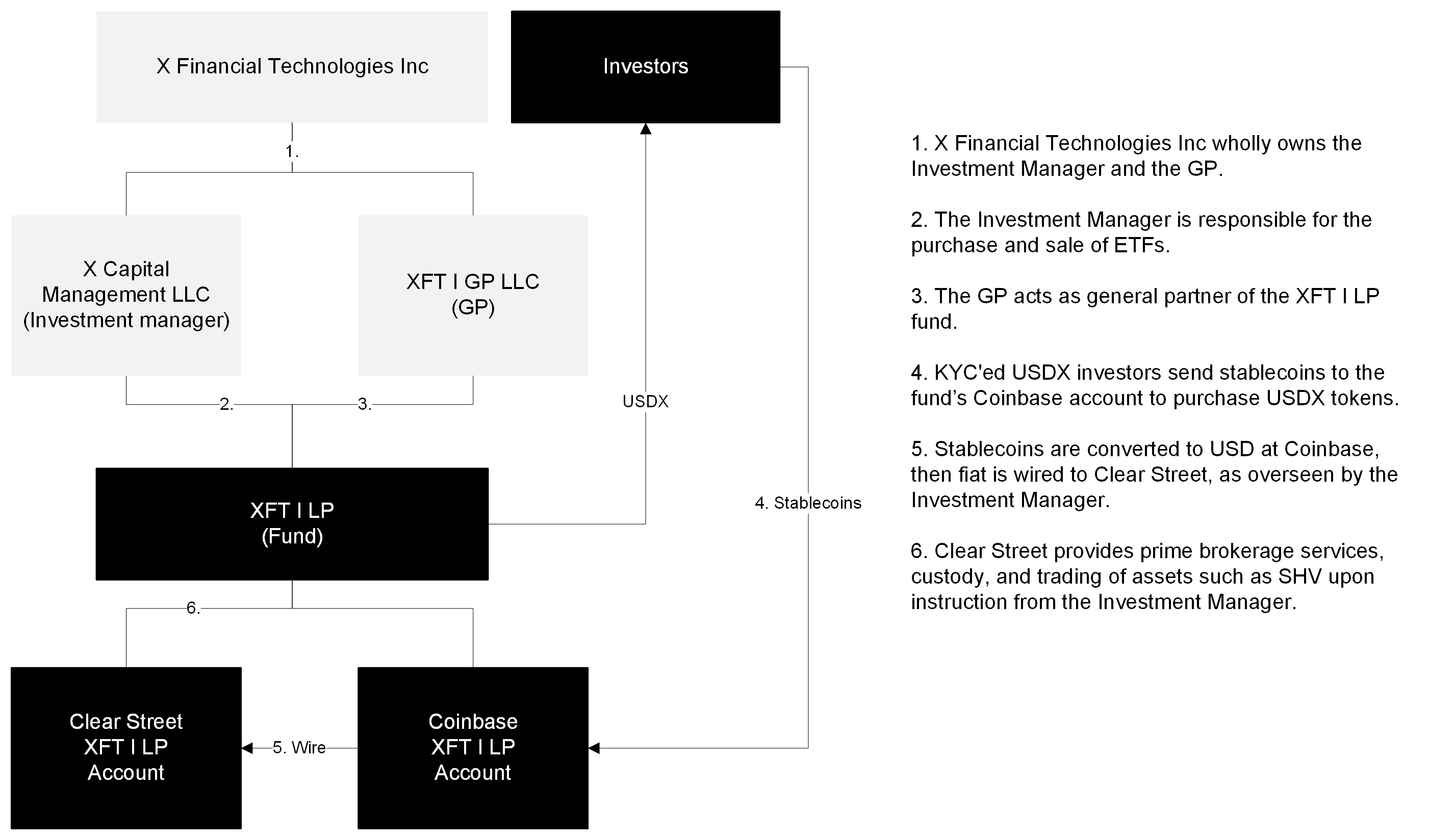

Benefits of traditional LP/GP fund structure

- 1. XFT tokens offer enhanced investor protection and lower risk compared to existing stablecoins.

- 2. XFT's LP/GP structure provides bankruptcy remoteness, as investors have the only claim on fund assets.

- 3. USDX tracks the investment results, including yield, of the underlying ETF.

- 4. Traditional LP/GP fund structure is well-understood by investors and regulators.

What are the risks investing in USDX?

- All investments involve risk, including loss of principal. There are risks associated with the issuance, redemption, transfer, custody, and record keeping of shares maintained and recorded primarily on a blockchain. For example, shares that are issued using blockchain technology would be subject to risks, including the following: blockchain is a rapidly-evolving regulatory landscape, which might result in security, privacy or other regulatory concerns that could require changes to the way transactions in the shares are recorded. The fund's yield may be affected by changes in interest rates and changes in credit ratings. These and other risks are discussed in the fund’s prospectus.

- You could lose money by investing in the fund. Although the fund seeks to preserve the value of your investment at $1.00 per share, it cannot guarantee it will do so. An investment in the fund is not a bank account and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. The fund’s sponsor is not required to reimburse the fund for losses, and you should not expect that the sponsor will provide financial support to the fund at any time, including during periods of market stress. Although the fund invests in U.S. government obligations, an investment in the fund is neither insured nor guaranteed by the U.S. government.

- Investors should carefully consider a fund’s investment goals, risks, charges and expenses before investing. To obtain a summary prospectus and/or prospectus, which contains this and other information, visit x-financial-technologies.replit.app. Please carefully read a prospectus before you invest or send money.

How is my idle cash is utilized?

Your idle cash linked through your payment provider is pooled into a money market fund. The fund invests this cash to earn yield, which is distributed to you via rebasing—your token balance increases automatically as yield accrues, while the token price stays constant. Rebasing simplifies distributing yield by automatically increasing users' token balances while keeping the token price constant (e.g., $1). This method makes receiving cash inflows seamless and easy to track.

Example:

- Day 1: You link $1,000 of idle cash.

- Investment: The fund invests your $1,000.

- Yield Accrues (e.g., 2%): Your balance grows to $1,020.

- Rebasing: Your token quantity increases to 1,020 tokens at $1 each.

- Day 2: You have 1,020 tokens worth $1,020.

This process lets you earn yield on idle cash effortlessly, with the growth reflected in your increased token balance.

Who can access USDX?

Incorporated businesses can open an account with XFT to mint and redeem USDX 1:1, as long as the business falls in our terms and conditions.

What rights do tokenholders have?

Holders of USDX tokens are, by definition, limited partners in the Fund and therefore have statutory rights of limited partners under the Delaware Revised Limited Partnership Act and contractual rights under the Fund’s Amended and Restated Limited Partnership Agreement and the applicable Subscription Documents (available here), including limitation of liability. Tokenholders can further avail themselves of protections of applicable regulatory bodies outlined in Section IV.2 above.